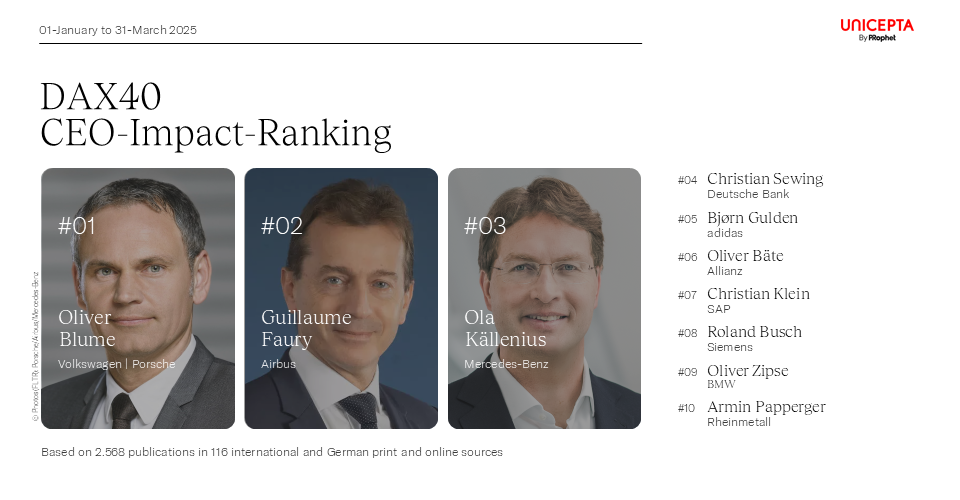

CEO-Impact-Ranking for Q1 2025: VW-CEO Oliver Blume on Top

The Frankfurter Allgemeine Sonntagszeitung published UNICEPTA’s CEO Impact Ranking for Q1 2025 on Sunday.

Oliver Blume leads the ranking – with particular focus on Porsche’s strategic shift, VW’s cost-cutting measures, and mounting political pressure.

Airbus CEO Guillaume Faury claims second place, buoyed by extensive media coverage of long-term technology initiatives and delays in the hydrogen aircraft project.

Mercedes-Benz CEO Ola Källenius secures third place. Media attention has increasingly focused on his company’s shift in propulsion technology strategies and an internal resistance to cost-cutting measures.

14.04.2025

A key driver of media visibility in the first quarter has been growing concerns over potential new trade conflicts. Following the U.S. government transition and Trump’s tariff announcements, internationally oriented DAX companies – most notably Volkswagen, Airbus, and Mercedes-Benz – have come under increased scrutiny. Their CEOs have publicly commented on protectionist trends, investment strategies in North America, and the risks of a decoupled global economy. This geopolitical intensification has amplified the need for strong communicative leadership, a reality that is clearly reflected in the current CEO ranking.

Oliver Blume stands out in this complex picture. Few CEOs are as much in the public spotlight as he is. The ambitious electric vehicle plans at VW and Porsche are faltering sales, especially in China, are weakening – and Porsche’s once-iconic Taycan is quickly turning into a cause for concern. Wirtschaftswoche describes the situation at Porsche as an “a crisis in the electric segment, marked by recalls and restructuring.” Blume has reacted with a strategic pivot: Porsche is investing once again in internal combustion and hybrid models while embracing a more flexible production strategy. Volkswagen itself is undergoing a radical transformation – 35,000 jobs are set to be cut by 2030, while billions are being invested in software, batteries, and more affordable electric models.

In an interview with Der Spiegel, Blume openly discussed the challenges of transformation: “In 2025, we aimed to sell as many purely electric vehicles and plug-in hybrids as we did combustion engines. The overlap between combustion and battery variants was meant to ease customers into electromobility.” When speaking to Reuters about global competitiveness, he added: “Competition in China is immense, with many new automotive players entering the market.” He also emphasized: “Volkswagen is investing double-digit billions in factories, partnerships, software and batteries in North America – and that should play a significant role there.”

Significant organizational changes are also underway. At Porsche, board positions have been reshuffled, and Blume even took a pay cut – a clear signal to the workforce. Additional public attention is being drawn by a ruling from the Berlin Administrative Court: Private SMS exchanges between Blume and former Finance Minister Christian Lindner must be disclosed. Der Spiegel hints at a possible case of political interference, once again highlighting the CEO’s pivotal role at the intersection of business and politics.

Airbus-CEO Faury ranked second, Källenius (Mercedes-Benz) on third place

Airbus CEO Guillaume Faury takes second place in the current ranking. Media coverage of the aviation giant is marked by both progress and delays. The focus is on their ambitious hydrogen aircraft, whose series production has reportedly been postponed significantly – now expected to debut roughly a decade later than initially planned, due to budget cuts and infrastructural shortcomings according to reports by the Frankfurter Allgemeine Zeitung and Reuters.

Faury also positions himself internationally as a thought leader. At the Paris AI Summit – an event covered by The New York Times among others – he advocated for a stronger European role in developing trustworthy artificial intelligence. He also clearly addressed global competition and the risks of new U.S. tariffs in discussions with Reuters. His media visibility is thus driven not only by technological innovations but also by his active participation in geopolitical debates.

Mercedes-Benz CEO Ola Källenius secures third place in the ranking. Although he expressed optimism about the role of the U.S. as a market in a January interview with Bild am Sonntag, his recent statements on Europe have taken center stage. As Chairman of the ACEA (European Automobile Manufacturers Association), he has called for a more realistic implementation of the Green Deal in Frankfurter Allgemeine Zeitung. In an interview with Handelsblatt, Källenius described the industry's situation as a “transformation of the century” – driven by geopolitical uncertainties, sluggish electrification, and growing competition from China. He also questioned the EU’s mandate to phase out combustion engines by 2035 and advocated for technology-neutral, market-oriented regulatory mechanisms. Furthermore, he warned of a potential trade conflict with the U.S. and urged for the mutual reduction of tariffs. “If high tariff barriers were to persist permanently, we might even have to adjust our industrial structure,” Källenius stated.

Christian Sewing (Deutsche Bank) and Bjørn Gulden (Adidas) complete the Top 5 of the most media-visible CEOs

Christian Sewing, CEO of Deutsche Bank, is ranked fourth. He is pushing forward with a determined restructuring program. According to Handelsblatt in mid-March: “With the ‘Deutsche Bank 3.0’ program, Sewing aims to reorient the bank towards profitability, efficiency, and improved margins.” His approach focuses on flatter hierarchies, simpler structures, and a comprehensive efficiency strategy – a message that has also made it into Wirtschaftswoche, the Börsen-Zeitung, and the Financial Times.

Another strong sign of continuity: Sewing will remain at the helm until 2029. With CFO and his deputy James von Moltke set to leave next year, Sewing now stands virtually unchallenged – there is no clear number two on the board, according to FAZ. Sewing also emphasizes his goals in terms of diversity and sustainability – most recently early March at the balance sheet press conference, as reported by the Süddeutsche Zeitung.

Adidas CEO Bjørn Gulden rounds out the Top 5. Under his leadership, Adidas has redefined its brand image with noticeable impact. Just a year after the symbolic loss of the DFB kit sponsorship to Nike – which was seen as a severe setback in Germany – Adidas has shown renewed strength. Die Welt writes, “Adidas CEO Bjørn Gulden has engineered an impressive comeback for the Bavarian sportswear maker in record time.” Gulden’s strategy is built on a significant departure from previous approaches. Rather than prioritizing online exclusivity, he is refocusing on brick-and-mortar retail, reintroducing retro classics such as “Samba” and “Gazelle,” and enhancing operational efficacy by eliminating up to 500 positions at headquarters and decentralizing decision-making. Handelsblatt also highlights a new partnership with the Mercedes Formula 1 team since 2024 – an unmistakable signal of Gulden’s global ambitions to make the brand more emotionally engaging, internationally resonant, and closer to the consumer.

The remaining places in the Top 10 ranking are as follows: 6th Oliver Bäte (Allianz), 7th Christian Klein (SAP), 8th Roland Busch (Siemens), 9th Oliver Zipse (BMW), 10th Armin Papperger (Rheinmetall).

For the CEO Impact Ranking, UNICEPTA’s media intelligence experts in Cologne analyzed 2,568 posts from 116 German and international print and online sources published from January to March 2025. The ranking is based on results from the UNICEPTA “DAX Benchmark,” which continuously tracks the media presence of all DAX companies and their CEOs, as well as the likelihood of pick-up, thematic focus, and tone of media reporting.

About UNICEPTA

UNICEPTA, part of Stagwell’s PRophet comms tech suite, is a leading global media intelligence provider, combining advanced technologies, AI, and human expertise from over 500 specialists to deliver insights from vast media as well as numerous other data sources - in real-time and at any other desired time. This helps communicators and decision-makers spot trends early and make informed choices. Supporting global companies and organizations, UNICEPTA offers strategic insights and precise media monitoring to guide management, communication, and marketing. UNICEPTA’s offices are located in Berlin, Cologne (headquarters), Krakow, London, Paris, Shanghai, São Paulo, Washington DC, and Zurich.

Contact

UNICEPTA GmbH

Salierring 47-53

50677 Köln

Carlo Persico

Tel: +49 221 9902

carlo.persico@unicepta.com