Bagging a bargain: insights from the second hand fashion scene

Since the summer of 2022, we have been charting the impact of the cost of living crisis on people’s consumption habits, across the food, energy, and personal finance spheres. For this issue, our attention turns to fashion.

From Depop to Facebook marketplace, Vinted to Vestiaire, the options to buy pre-loved clothing are no longer limited to charity shops and car boot sales. It has been impossible to ignore the increasing number of second hand marketplaces operating and their growing popularity with consumers. There are predictions that this growth is set to continue, with the global second hand clothing market expected to increase by 86% by 2026. In this report, we explore the rise of second hand fashion through the lens of UK consumer social media posts. We analyse the motivations for seeking out second hand style, compare and contrast the audiences talking about second hand shopping vs. fast fashion, and ask whether the trend will impact the bottom line for brands at the affordable end of the market, such as Primark, Shein, Boohoo and Zara.

Motivations for second hand clothes shopping: »Some people just don’t know what they have. I picked this gem up for peanuts!«

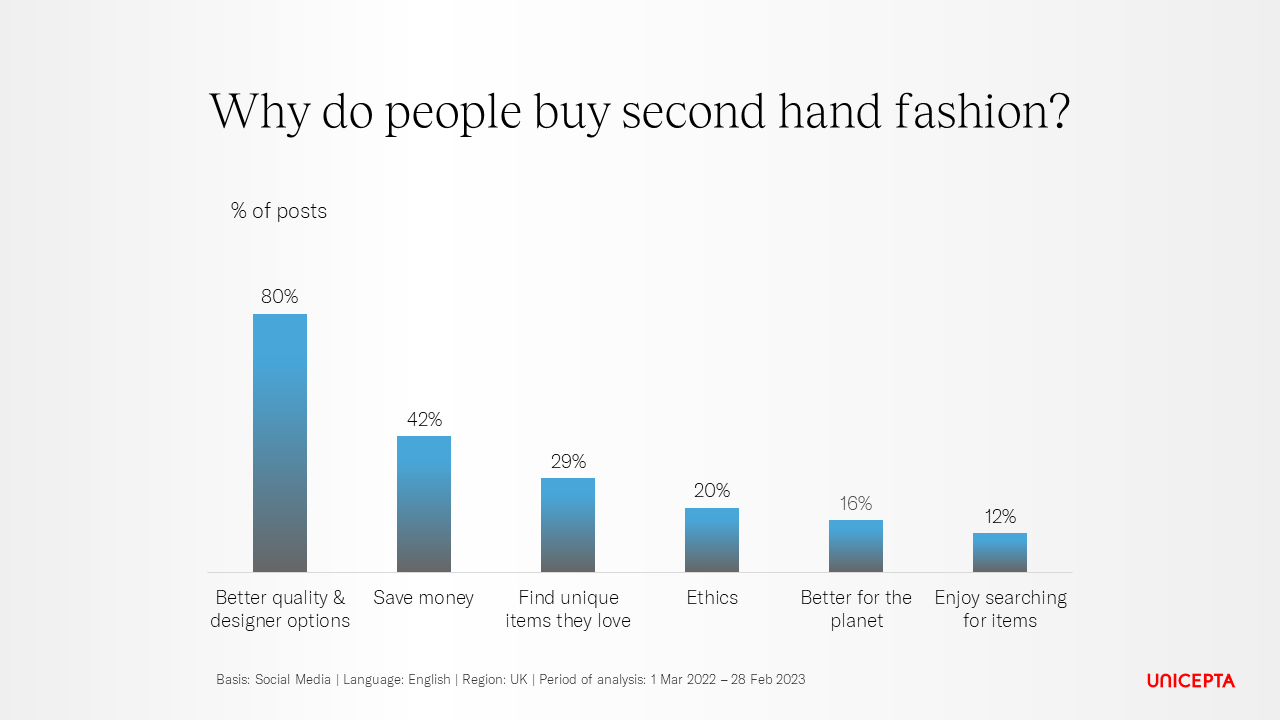

People discussing their second hand clothing consumption habits talked most often about saving money and getting a good deal (42% of posts). Consumers frequently shared posts showing off their bargain fashion finds, often mentioning buying branded items for a fraction of the original retail price.

Buying second hand to help save the planet and living a more sustainable lifestyle was mentioned significantly less than getting a bargain (16% of items) with posts focusing on the ethical element of pre-owned compared to purchasing from fast fashion being minimal (2%). Consumers referred to the enjoyment of finding unique pieces that they loved in more posts than both of these issues combined (29% of posts), while 12% of posts emphasised how much fun it was to search for second hand 'treasure': »The absolute gems I find on Vinted is crazy, I’m obsessed. Take all of my money.« These motivation factors were often interlinked, with second hand shoppers referencing saving money while also saving the planet, or being able to find high quality pieces at lower cost: »I need new clothes and second hand is cheaper than sustainable brands, and much better than fast fashion«. 8% of posts referenced second hand items actually being as good as new, with tags on, or hardly worn. One person commented: »I wish more people knew that buying second hand can mean the item is unworn or barely worn.«

Profiling second hand shoppers vs. fast fashion fans: »Charity shops are being mined by trendies to get their fashion fix via second hand rather than Shein«

When analysing the consumers who discussed purchasing from fast fashion brands, compared to those who talked about buying second hand style, the two audiences were found to be remarkably similar. Both audiences were female-dominated, with the fast fashion users slightly more so (67% female, vs. 62% for second hand shoppers). The audiences were both overrepresented by people in the under 25 age group (48% of fast fashion users, vs. 47% of second hand shoppers). The interests and influences of the two audiences were also remarkably similar, demonstrating an affinity with British culture (the BBC, Very British Problems, the NHS), left of centre politics, and money saving expert Martin Lewis.

Small, but notable differences included a propensity for cultural and creative interests in the second hand shoppers’ group, while the fast fashion fans were more likely to have an affinity with pop culture and reality TV stars. One can hypothesise that second hand fashion appeals more to those with a creative eye who are motivated to spend time curating a unique look, while fast fashion allows people to imitate style trends from pop culture influencers. An area of crossover was the recent trend for fashion from the 90s and 'Y2K' making a comeback. Reselling marketplaces offered fashion-conscious young people the opportunity to get their hands on 'vintage' items from the era, rather than modern day replicas from fast fashion brands:

There were far more similarities between the two audiences than differences, and one can surmise that most individuals who are fast fashion shoppers also have the potential to buy from, or already buy from, second hand marketplaces. We saw evidence of this in users showing off outfits from a mix of fast brands and second hand sources: »My clothes are a blend of Shein and eBay and charity shops!«

Looking more closely at segments within second hand shoppers, we found that there are tribal differences between Depop and Vinted users. Vinted users' personality, influences and affinities were more closely related that of charity shop users than Depop users. Depop users were more similar in personality type to fast fashion shoppers - hedonistic, excitement seeking, sociable, carefree - and both had a higher affinity with celebrity and influencer culture than Vinted and charity shop users.

Emerging tensions around second hand shopping: »Bargain hunting is fun if you don’t have to do it to afford essentials«

Despite the boom in second hand shopping, we noted some emerging tensions around the quality and value of pre-owned pieces. Some complained that charity shops and other second hand options were becoming too expensive for the quality of items on offer, in part due to an influx of items from fast fashion brands such as Shein and Pretty Little Thing. »Vinted & Depop are plagued with £1 Shein clothing that has been worn once and is already falling apart, same in charity shops.«

There were also accusations of sellers on marketplaces listing high street or fast fashion items at high prices, particularly trending items with low stock in stores: »I just want to buy a Zara jacket but because Molly Mae posted it on Instagram the Depop girlies are trying to sell it for £120«.

There was a considerable amount of criticism of Depop sellers in online discussion, particularly around price inflation. The 'Depop girlie' stereotype was at the heart of this criticism, with sellers on the platform regularly accused of buying up items from charity shops and reselling at high cost online, thus reducing the chance of finding quality and desirable pieces at low cost: »The Depop girlies buy out all the good stuff from charity shops and flip it, leaving us with only scraps to pick from«.

Some concluded that those with genuinely tight budgets were more likely to turn to fast fashion brands, as they were more reliable when seeking essentials: »Bargain hunting is fun if you don't have to do it to afford essentials. Buying clothing second hand is more expensive and less reliable than buying from Primark or a supermarket. Anyone who doesn't know that hasn't been broke for a long time.«

Fast fashion brands and the impact of the pre-owned boom: »The greenwashing! I cannot cope!«

Our findings lead us to conclude that fast fashion brands should consider Depop in particular, but also Vinted, eBay, and other second hand marketplaces as competitors, and to expect to feel real pressure on their market share from these businesses, especially in the youth segment. Attempts by retailers to embrace the growth of pre-loved clothing need to be carefully thought through though, as there has been a backlash against attempts by brands such as Shein, Zara and Pretty Little Thing, to launch their own resale sites. Conscientious consumers see such moves as an attempt to jump on the pre-loved bandwagon and make accusations of greenwashing: »I really want to believe that ppl won’t fall for Shein resale greenwashing.« Businesses with a poor reputation around the ethics and sustainability of their supply chains will continue to come under scrutiny for moves into the second hand market which don’t address these underlying issues.

Our findings suggest that consumers are highly price sensitive and this is a key motivator for second hand shopping, though other factors, including quality and sustainability also play a key role in purchasing. In the cost of living crisis, brands could tap into the need for high quality, long lasting but affordable basics, which cater to those on a lower budget and are less easy to access reliably in the second hand market. Offering more 'limited edition' lines may also help to meet the desire for unique items to stand out from the crowd.

To understand how Unicepta can help your organisation predict trends and surface opinions hidden within consumer conversations contact us here.